Navigating maternity pay can be complex for employees and employers alike. Understanding how to calculate maternity pay, the entitlements involved, and the methods of support available is crucial for both personal planning and business compliance. In this guide, we’ll cover everything you need to know about maternity pay entitlements, calculating statutory maternity pay, and ensuring compliance with the legal maternity pay period.

Jump to:

- Maternity Pay Entitlement: What It Includes

- Working Out Maternity Pay: The Basics

- Calculating Statutory Maternity Pay: A 5-Step Guide

- Maternity Pay Advice: Tips for Employers and Employees

- Calculating Maternity Leave Pay: Understanding Weekly Payments

- Understanding the Maternity Payment Period: Key Dates to Know

- Statutory Maternity Payment: Financial Support for New Parents

- FAQs: Maternity Pay calculations and entitlements (2025)

- Conclusion

Maternity Pay Entitlement: What It Includes

Maternity pay entitlement is designed to support employees during their maternity leave, ensuring they have a stable income while taking time off. Statutory Maternity Pay (SMP) is the government-mandated minimum payment that eligible employees are entitled to during maternity leave. Here’s what it entails:

- Eligibility: To qualify, employees must have been continuously employed for at least 26 weeks by the 15th week before the baby’s due date and earn at least £123 per week.

- Entitlement duration: Eligible employees are entitled to 39 weeks of maternity pay, divided into an initial higher-rate period and a subsequent flat-rate period.

Understanding your maternity pay entitlement can help with financial planning, ensuring you know exactly what to expect.

Working Out Maternity Pay: The Basics

Calculating maternity pay is a straightforward process once you understand the required steps. Generally, maternity pay is calculated based on the employee’s average weekly earnings over a specific period. Here’s how it works:

1. Determine the qualifying period

The maternity pay calculation is based on average weekly earnings over an eight-week period, usually from weeks 17 to 25 of pregnancy.

2. Apply earnings rules

The first six weeks are paid at 90% of average weekly earnings, followed by a fixed weekly payment for the remaining 33 weeks.

3. Plan for tax deductions

SMP is subject to income tax and National Insurance contributions, so deductions may apply.

By working out maternity pay in advance, employees and employers can ensure timely, accurate payments during the leave period.

Calculating Statutory Maternity Pay: A 5-Step Guide

Calculating maternity pay doesn’t have to be complicated. Follow these five steps to determine the correct amount and ensure timely payments:

Maternity Pay Advice: Tips for Employers and Employees

Navigating maternity pay can raise questions, especially for employees planning for leave and employers ensuring compliance. Here are some tips for both parties:

- Review maternity policies: Employers should provide clear guidelines on maternity pay in employment contracts and handbooks to ensure transparency.

- Plan for budget adjustments: Employees may want to adjust their budgets, as SMP may not fully cover previous income levels. Understanding maternity pay in advance can aid with planning for any necessary savings or support.

- Seek professional advice: For complex cases, consulting with a payroll specialist can help both employers and employees address specific questions regarding eligibility and payments.

Proactive maternity pay advice can simplify the experience, ensuring that employees feel supported and employers remain compliant.

Are you an employer? Read out maternity pay guide for employers below:

Calculating Maternity Leave Pay: Understanding Weekly Payments

Statutory Maternity Pay is issued weekly or monthly, depending on the employer’s payment schedule. To calculate maternity leave pay, consider the following factors:

- Weekly payment calculation: If an employee is paid weekly, SMP will be calculated and issued based on the same frequency. The amount remains consistent unless the employee’s weekly earnings fall below the standard flat rate.

- Monthly payment schedules: If paid monthly, SMP may be combined into a single monthly payment, ensuring it aligns with the employee’s usual payment frequency.

- Ensuring accurate payment periods: Employers must ensure that payments cover the correct maternity pay period, whether weekly or monthly, to prevent any potential issues.

Understanding how maternity leave weekly payments are calculated helps ensure that employees receive accurate and reliable financial support during leave.

Read more information on the government website:

Understanding the Maternity Payment Period: Key Dates to Know

The maternity pay period covers up to 39 weeks of SMP, but it’s important to be aware of key dates and milestones:

1. Start date of SMP

Maternity leave can begin up to 11 weeks before the baby is due, but SMP typically starts when the employee begins their leave.

2. End date of SMP

SMP covers up to 39 weeks, ending before the employee’s maternity leave if they opt for the maximum 52 weeks.

3. Return to work planning

Employees who plan to take the full 52 weeks should communicate with their employer regarding their return date, which can help both parties prepare for the transition.

Knowing the key dates within the maternity pay period helps employees and employers manage maternity leave more effectively.

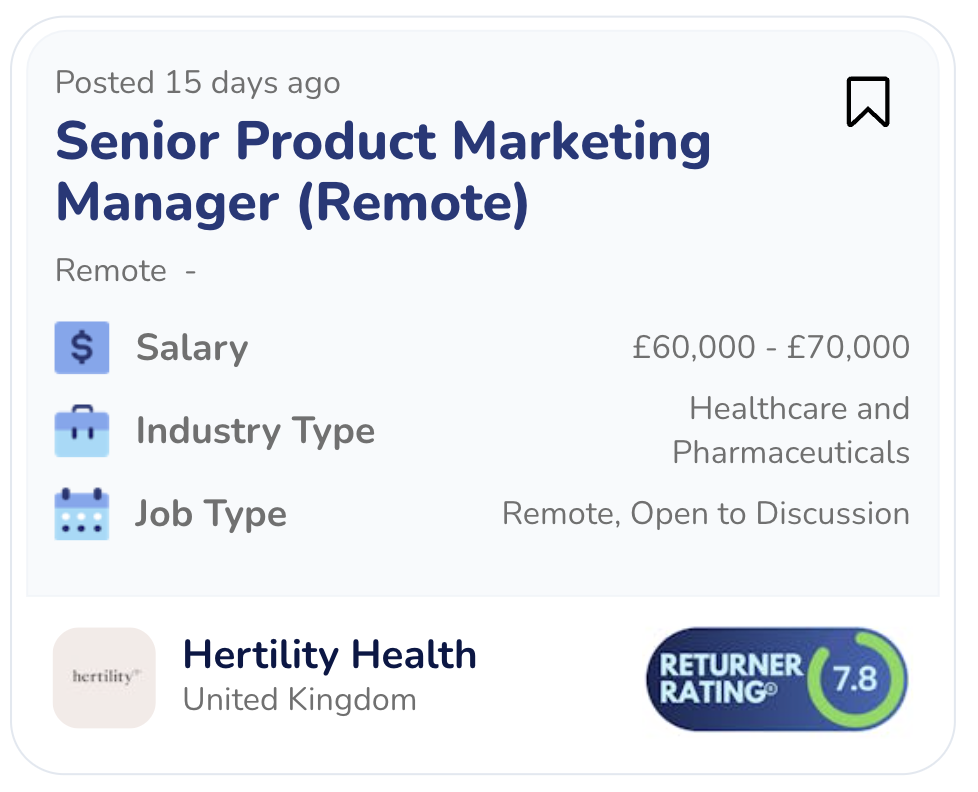

Hire female talent

With years of experience

Statutory Maternity Payment: Financial Support for New Parents

Statutory Maternity Payment is essential financial support for new parents, offering a stable income during the early months of parenting. Here’s what makes it an essential benefit:

Consistent financial support:

- SMP provides a predictable payment structure, allowing employees to plan for this period without disruptions.

Compliance for employers:

- Adhering to statutory payment requirements protects employers from potential fines and supports a positive workplace reputation.

Support for small businesses:

- Employers can reclaim up to 92% of SMP from HMRC, while smaller employers may be eligible to reclaim 103% of SMP, easing the financial impact on small businesses.

This statutory payment is a lifeline for many employees, and it ensures compliance and support for employers.

FAQs: Maternity Pay calculations and entitlements (2025)

Not sure how to communicate your return after maternity leave? We’ve got the PERFECT template for you:

Join the ivee community!

Join our Facebook group. Whether you’re looking to reconnect with like-minded returners, seek advice on returning to work after maternity leave, or share your experiences, our Facebook community is here to help you navigate your journey back into the workforce.

You’ll find:

👉 Latest regulatory changes regarding maternity leave

👉 CV templates for women returning to work

👉 Latest industry updates

👉 Resources and guides to help you on your job hunt

👉 Confidence-building events, webinars and advice on all aspects of returning to work

Our Facebook community

Conclusion: Understanding Your Maternity Pay Calculations and Entitlements

Whether you’re an employee preparing for leave or an employer ensuring compliance, understanding maternity pay calculations and entitlements is crucial. By calculating statutory maternity pay accurately, managing weekly payments, and knowing the key dates within the maternity pay period, employees and employers alike can navigate maternity leave confidently. Ensuring clear communication and understanding maternity pay advice will benefit all parties involved.

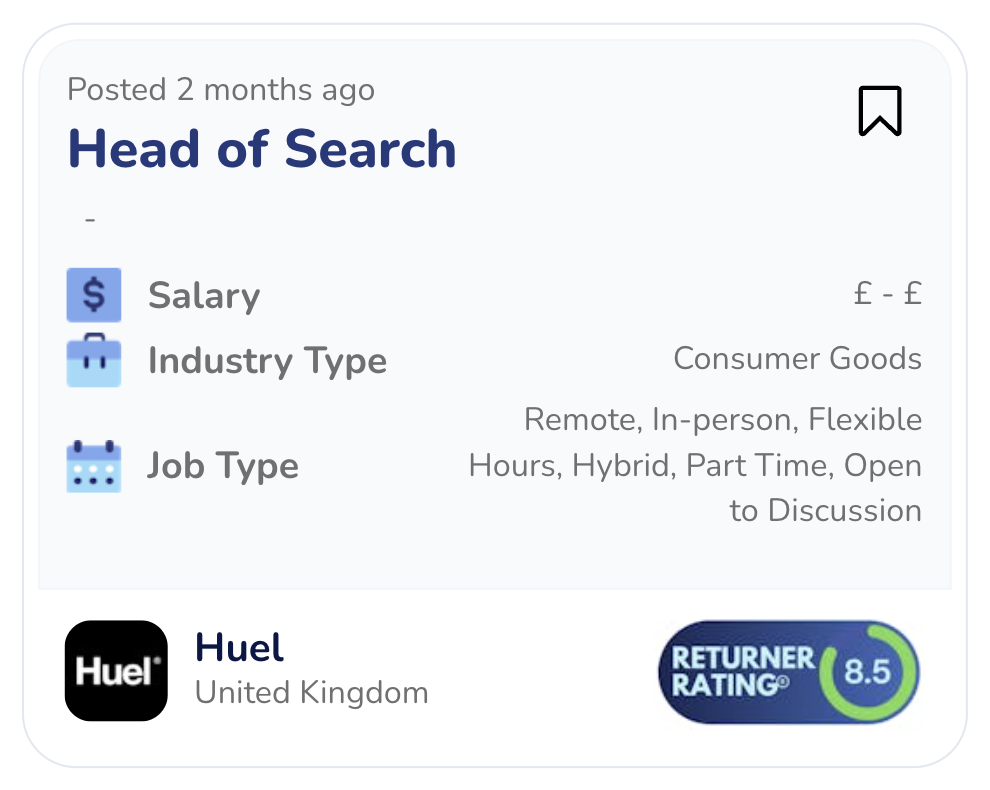

Ready to return to work?

Create an ivee profile and start browsing our flexible jobs today!

Create profile!Featured Blog Posts